Of the types of stock trading exchanges, limit orders can be some of the most direct trades for purchasing or selling stock at certain, favorable values. Following is a description of the exchange and its components, and some advice on how to place a limit order for buying or selling stock.

Type of Exchange: Limit Order

A limit trade is a type of exchange in stock trading that involves the investor’s setting a limit price, and the specified amount of shares will only be purchased or sold at that price, or at one more favorable. Although there is never any guarantee that these trades will go through, if the bid or ask price should reach the specified values, and position for buying or selling is right, they will execute in a beneficial fashion.

A buy limit could work like this: an investor at on online trading site is interested in buying stock X, presently trading at $4 per share, once (if) it drops to $3.50 per share. So, he could set a limit order to buy, say, 1000 shares at $3.50, and if at any point X should drop to that value or lower and other traders are willing to sell, the order will go through.

In a sell limit order, the investor, interested in selling stock Y, presently trading at $5 per share, could set a limit price of $6, and if at any point Y should rise to that value and enough people are looking to buy at $6 per share, the order will go through.

Difference between Limit and Market Trades

Limit exchanges guard traders from the dangers of market orders, which operate regardless of market value of any securities concerned. Market orders buy or sell stock at the next available time after the trade is set, meaning that, in a buy, if the stock should rise in value quickly, the buy will still go through, and in a sell, if the security’s value should plummet, it will still sell at that lower price.

By using limit exchanges, a buy on a skyrocketing security, or a sell on a plummeting stock will not go through if the market value unfavorably exceeds the limit price.

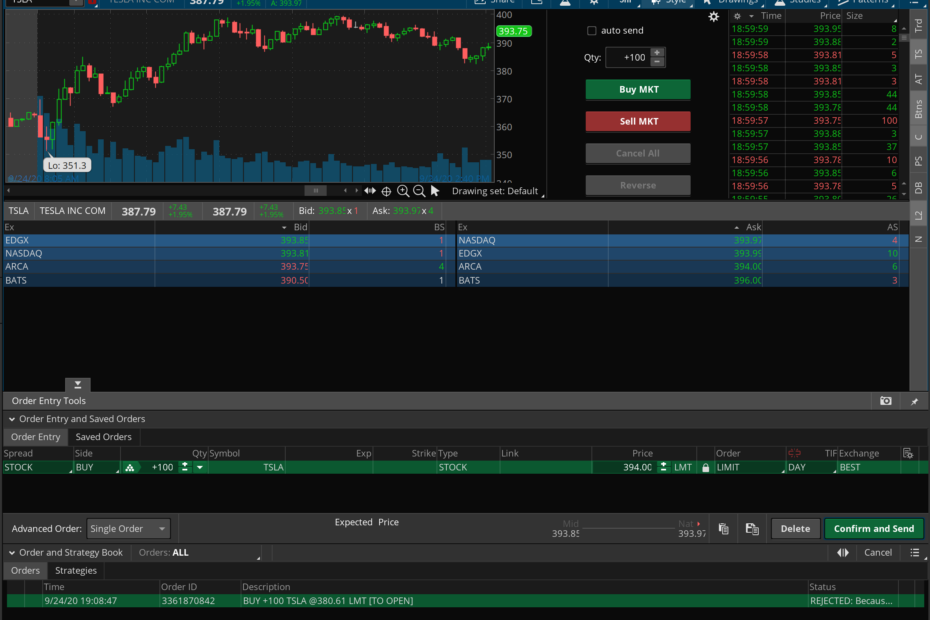

How to Place a Limit Order for Stocks

To place one of these exchanges, any trader must first pinpoint a viable security. The limit value in a buy should be set at a price lower than market value, but not so low that it represents a value below that which the security is liable to reach. This means that if the stock should drop to the limit price or below, it will buy, and the exchange will only go through as the market value matches the limit or is lower. For a sell limit order, the designated value should be higher than market value, and the order will only go through if the stock matches or exceeds that rate, so it is best to set reasonably higher, but not fantastic limit prices. The duration of these trades (the amount of time for which they remain live) can also be specified.

The components of limit orders are also applied in stop orders, which protect against loss, and stop-limit exchanges, which further narrow the amount that a trader is willing to buy or sell at. But to use these, it is important to learn how to place limit orders, as they are absolutely fundamental for trading success.