Scaling in is a technique that involves setting a buy price, and stock will be purchased there if it falls to the set level, and then, if the stock continues to drop, additional shares will be taken on at specified increments until all desired shares are bought or the stock stops decreasing in value. It is similar to scaling out, which sells at increasingly higher values. Following is some information on scaling in.

Scale In in Stock Trading

Scaling in means buying additional shares of a security as its value drops, which decreases the average price spent. This can be useful when an investor does not initially get the best price for a trade, as additional shares may be taken on as the price drops.

Example of Scaling In in Investing

Suppose that an investor is interested in buying 100 shares of a stock that presently trades at $5 per share once (if) its price drops. So, the trader can scale in by making a first buy for 20 shares at $4.50 (instead of buying all 100 desired shares there), and another 20 shares at $4.40, another 20 at $4.30, another 20 at $4.20, and the final 20 of 100 shares at $4.10 (if the price keeps dropping; otherwise, the process will end when the stock no longer reaches the set increments at which buys are activated). If this happens, and all 100 shares are purchased, the average price spent on these shares is $4.30, rather than $4.50, the initial price, which might have been spent on each share with a standard limit order.

How Scaling In Works in Trading

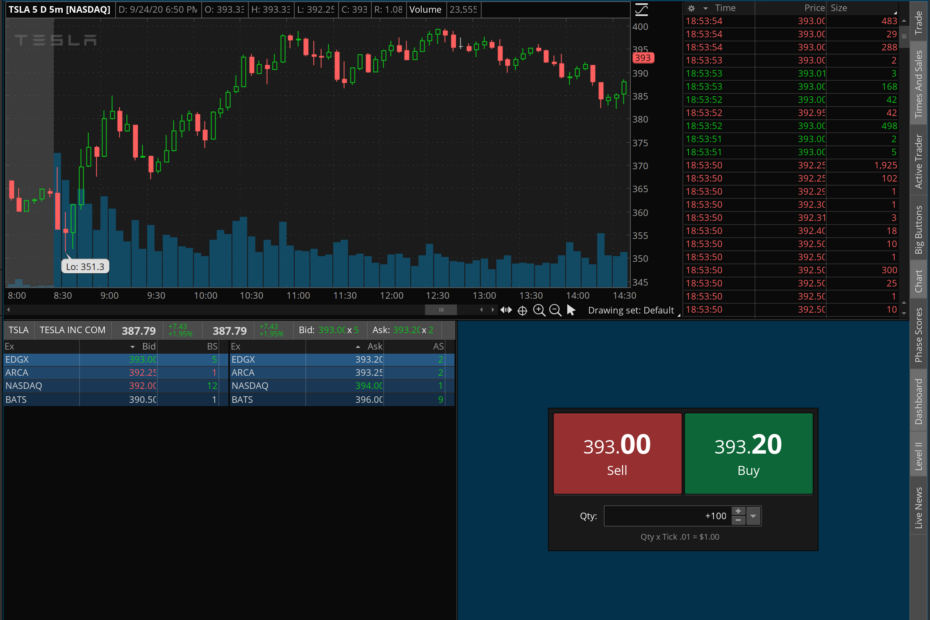

Scaling in works insofar as possible. As long as the stock keeps falling, and until the trade size is complete, the process will continue. An investor at discount brokerages like E-Trade, or TD Ameritrade may trade by scaling in.

At basic online stock trading sites, simply setting limit orders will do the trick. For instance, the above scenario (with the stock trading at $5 and the first buy at $4.50) would work for a trader who wanted 100 shares if she set a buy limit order for 20 shares at $4.50, another buy limit order at $4.40, and the remaining three orders, each with 10 cents less in limit price than the preceding trade. If the process works, it will work at least as favorably as the trader hoped; limit orders only act if they can buy at the set prices or at lower prices; if the stock gaps down, scaling in is particularly cheaper.

Overall, for someone who is interested in taking on stock that is falling or is likely to fall, scaling in can reduce the amount spent. Though there is not any guarantee that all shares will be bought, less will be spent in buys overall if the amount spent keeps decreasing.