Value investors, such as Benjamin Graham and Warren Buffet, have made large profits from buying fundamentally strong stocks that are trading far below their fair value. High growth investors such as William J. O’Neil, author of How to Make Money in Stocks, asserts that stocks with high and increasing growth rates make some of the best stock picks. Can an investor have the best of both worlds?

Value Investing Picks

One value investing screening tactic is to purchase stocks with consistently high earnings per share. High EPS means that the stock float is not overly diluted with shares. As well, steady earnings make it easier to forecast long term price projections.

A second factor for value investors to scan for would be a low price to earnings ratio. If the PE ratio is 10, the price of the stock is 10 times higher than the annual earnings per share. Therefore, a stock that earns one dollar per share in 12 months with a PE of 10 would be worth $10. The assumption is that if the stock adds these earnings into the share value, the stock should theoretically increase 10% in value every year. Of course there are many other factors to consider.

While many value investors focus on price to earnings ratios, the price to sales or revenue should not be forgotten. Earnings can increase by selling of property and assets, or by decreasing production costs. These forms of increasing earnings are not sustainable. If the EPS rises because overall sales increased, the increased earnings could develop into a long term trend. If the price of the stock is low compared to annual sales, this could create an undervalued stock situation.

A low price to book ratio may provide stability of price. Book value is the net worth of the company with all of the assets added together minus the liabilities. If the company has a ‘liquidation’ value of $10 per share and is trading at $200 dollars per share, the floor is a long ways down if company crashes. If that same stock is trading at $12 per share the value investor has elevated confidence.

Growth Stock Investing Ideas

Growth investing scans usually require a high annual earnings growth rate of at least 25%. Some will even go so far as to require accelerating growth rates.

In addition to high growth rates, investors may also want to see productivity with the assets and cash in the company’s possession. A lofty return on equity and cash is another fundamental screening criteria many traders will look for.

Combining Growth and Value Screening

These variables could theoretically produce undervalued stocks with high growth potential.

- Earnings Per Share > 1.25

- Price to Sales < 1

- Price to Earnings < 10

- Price to Book Ratio < 1.5

- Earnings Growth Rate over Past 5 Years > 25%

- Return on Equity > 20%

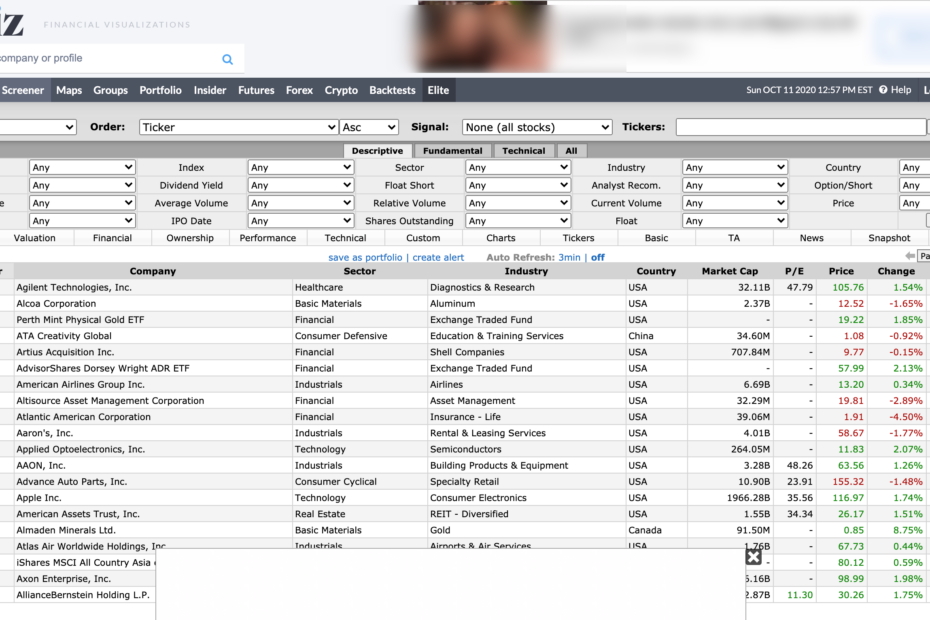

The stock screen linked here will have very similar results to the criteria above.

Warning on Undervalued Growth Stocks

A short list of very ‘Buffet-like’ stocks will appear with the above scan. However, investors need to be very careful with their next step. Due diligence is an absolute must as many undervalued stocks with high former growth rates are devalued for a good reason. One must investigate whether the company is experiencing legal problems or serious future revenue concerns.

Sometimes though, investors will find a true gem that has merely fallen out of favor for a while before rocketing up to proper valuations. Following these fundamental screening criteria for growth and value stocks just might be the scan for today’s volatile market.