The trailing stop exchange is one of the most useful trades for buying into stock at the right time. It follows a given security’s course, and purchases at a set time, which signals (according to the investor), the beginning of an increase in value. This order can be used by individual investors at discount trade sites like Robinhood, E-Trade, and TD Ameritrade. Following is some advice on how to enter a trade using the trailing stop order.

Buy Trailing Stop Order in Stock Trading

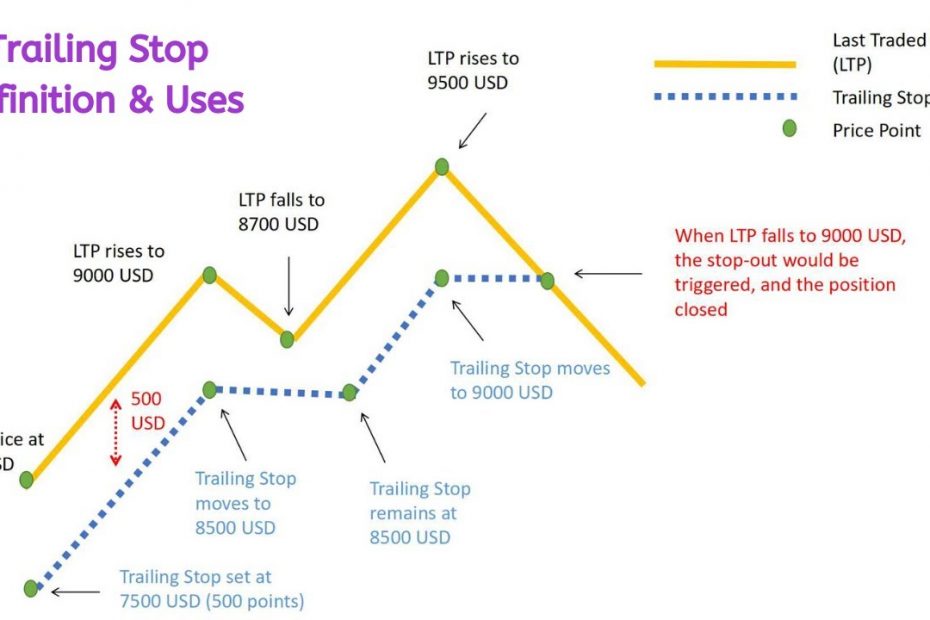

This buy exchange in investing is meant to purchase a stock once it shows a certain, specified amount of improvement, which, to the investor, might signify an uptrend. A trailing amount, either in the form of a dollar amount or a percentage is set, and once the security experiences that increase from the lowest value that it experiences after the order is set, the buy will act.

Example Buy Trailing Stop Exchange

For example, suppose that a stock is trading at $5 per share. An investor could set a buy trailing stop order with a trailing amount of $1. If the stock should rise outright (and never sink below $5), it will buy at $6, an increase of the trailing amount. If the stock should find its way down to $4.70, and then reach $5.70 before dropping below $4.70, the buy will take on stock at $5.70. Or, suppose that it works its way down to $2 per share. If it then turns around, and hits $3, it will buy there, after a $1 increase from the lowest value that it experiences.

The percentage trailing amount may also be used. If a 10% trailing amount is set on a stock trading at $5 per share, if it rises outright to $5.50 (an increase of $0.50, which is 10% of $5), the order will activate. If it drops to $3, and then rises by $0.30, it will take on shares at $3.30 after the 10% increase from the lowest value.

How to Enter a Trade Using the Trailing Stop Order

Entering a trade means buying into stock. Often, this entails setting a designated entry point beforehand, but this particular exchange allows for the entry point to automatically adjust, so that less will be spent if the stock drops. This is more complex and often more useful than the standard stop order, which only buys at a set price, not at a set increase in value.

To enter a trade in investing by using the trailing stop order, find a stock that is likely to increase in value, especially if the increase is expected to be delayed, occurring after the price drops even more. Then, set a trailing amount that, to you, indicates an actual uptrend, or an increase that shows enough momentum that the bullish course might continue. This way, once the price increases by the set amount (or percentage) from the lowest value that the stock reaches after the order is set, it will act.

The trailing stop exchange is an excellent investment tool. It automatically follows any stock concerned, and it can buy when a stock shows the right amount of upward momentum, allowing for a later sell, which can secure favorable returns if the investor predicts a stock’s course correctly.

By clicking on the click and signing up for an account, I earn a commission, no extra on your part 🙂