Determining the Value of a Stock in the Market

If someone asked five seasoned investors how to determine a stock’s value, they would likely get five different answers. Finding undervalued stocks are often difficult since the trading price is fair market value in the mind of the investor. But there are some ways to guess which stocks might be unfairly penalized and could rebound in the future.

Undervalued Stocks Based on Price to Earnings Ratio

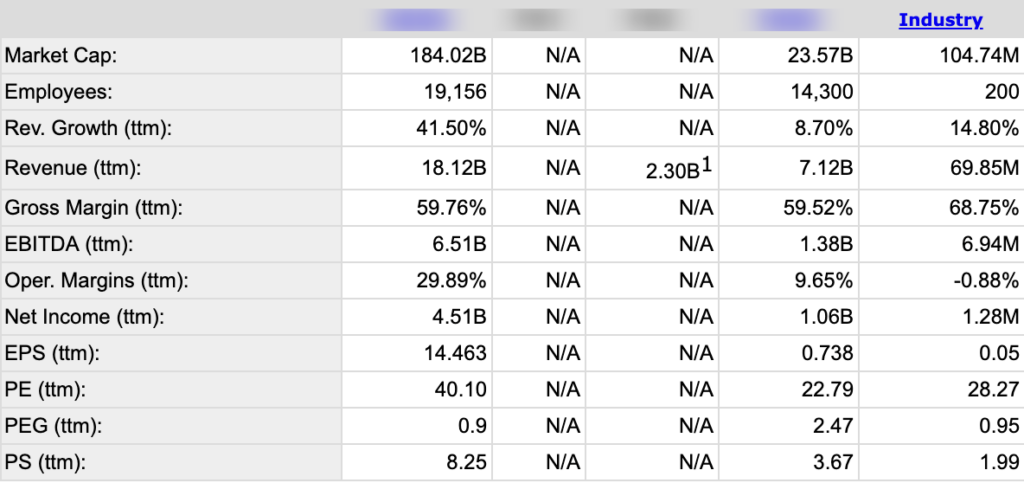

Perhaps this is the most common available tool to determine a company’s relative worth. Also referred to as a P/E ratio, this number is the current price of the stock divided by the annual net income. If the company shares are trading at 20 dollars and the earnings for the year are two dollars, the P/E ratio is 10. If the earnings for the year were four dollars, the P/E ratio would be five.

A trader using the Internet can quickly determine a company’s P/E versus a competitor or the industry to see its relative value. A company with a P/E ratio significantly lower than its competitors or the industry average might be worth a second look as a value pick.

Valuating Based on Price to Book Ratio

Another common tool to determine a stocks relative worth is the Price to Book ratio. The book ratio is the company assets minus any intangible assets and liabilities. Another way to describe this is if the company went bankrupt and all assets were sold at fair market value, how much per share would the company have in cash?

The current trading share price is divided by this book value to come up with the Price to Book ratio. A price to book ratio under the value of one could be considered a value pick since the current net asset value is worth more than current share price.

Value Pick Based on PEG

A P/E or price to earnings ratio only tells one about the current valuation of a stock. But what role does future growth play in determining a stocks value? The PEG ratio or price to earnings plus growth solves this problem.

Having the P/E ratio, merely divide it by the annual earnings per share growth. Some will list this per annum or for five years expected. Many investment sources will automatically calculate this number.

- A PEG ratio over 1 is often considered overvalued

- A PEG ratio of under 1 is considered to be undervalued

If the P/E is 20 and the expected growth per year is 20 percent, then the PEG is 1. This is neutral. If that same stock has an expected growth of 40 percent, the PEG is 0.5 which is a value pick.

Picking Undervalued Stocks Wisely

Of course, much caution is necessary when picking stocks that may be undervalued. More often than not, there is a good reason that these companies are trading less than their counterparts. Once an investor determines that the stock might be undervalued, further investigation is necessary to see if he feels the reasons are valid or not.

Sound investing calls for due diligence.