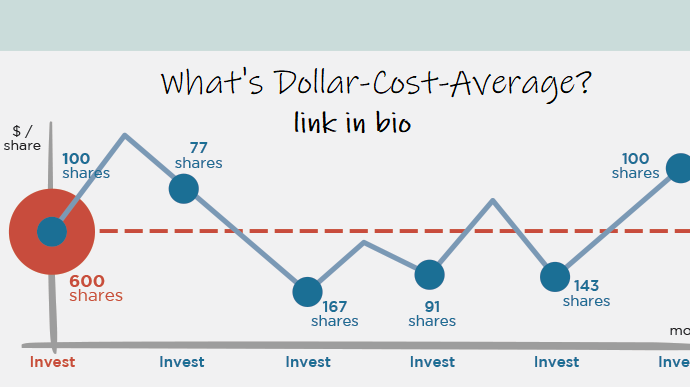

Dollar cost averaging (DCA, also called constant dollar plan) means incrementally buying stock according to a particular spending limit every so often for a set amount of time, regardless of the price per share, or the amount of shares. This ties into stock trading portfolio management, as traders who want certain stock often buy according to set spending limits rather than according to price or amount of shares. Following is some information on dollar cost averaging in investing.

Investing Dollar-Cost Averaging

Dollar cost averaging (DCA) means taking on shares of a specified stock based on a spending limit every so often for a specified period of time. this is based only on the amount spent. For example, in one buy, if a trader was willing to spend $100 on stock trading at $40, 2 shares would be bought. If the trader was willing to spend $100 on a stock trading at $9, 11 shares would be taken on.

This technique can, when it fits part of a schedule, lead to a lessened average price per share, as when stock is expensive, not as many shares are taken on, but when the same stock trades for less, more shares can be bought for the spending amount. Essentially, the DCA technique often favorably smooths out the price, so that, based on paid prices, shares can be taken on so that more are bought for less, and less are bought for more.

Example DCA and Stock Trading Portfolio

Suppose that an investor decides to spend $1,000 every couple of months on a stock. At first, it trades at $90 per share. Then, 11 shares will be bought (for $990) initially. Two months months later, suppose it trades at $80 per share. This time, 12 shares (for a total spending of $960) will be taken on. If it next trades at $50 per share after another couple of months has elapsed, 20 shares (for $1,000) will be added to the portfolio.

So, in taking on 11 shares at $90, 12 at $80, and 20 at $50, $2,950 is spent on 43 shares, which means an a $68.60 is spent per share, although the average of 90, 80, and 50 is 73.33 (meaning that the constant dollar plan lowers the average price by buying more shares that trade at lower prices than it does of those that cost more).

If not for this strategy, buying 43 shares at once at $90 would cost $3,870. The investing dollar cost average determines how many shares to buy each time by seeing how many can be purchased based on the spending limit, which means that less shares will be bought if the price is high, and more can be bought for the same price when it is lower.

This periodic trading strategy is meant to lower the average price per share, as more shares can be bought for a set amount when the price is low than when the price is high. If a stock is first bought low, and then it rises, leading to additional (but not quite as many) shares added to the stock trading portfolio at higher prices, the average price will increase some as shares are taken on at higher prices, but this increase is not as substantial as the decrease in average cost when share prices are lower, as more shares can be taken on for lower costs, greater (favorably) influencing the average when price is low. This can help out the portfolio as a whole.

By clicking on the click and signing up for an account, I earn a commission, no extra on your part 🙂