Making and Losing Money on a Risky Stock Investing Strategy

Buying options on stocks can be one of the most profitable trades, but all of the investor’s principle is at risk. It is possible, even likely, that many trades will result in the full loss of the initial investment.

This article will use the term investor for the person holding the option, but naked options are much more like speculation and gambling than investing. Options are called naked when there is no offsetting stock position.

Definition of Stock Options

A stock option allows the holder to purchase or sell a certain number of shares of stock during a specific time. A call option is held to purchase shares; a put option allows a sale of stock at what is called the strike price.

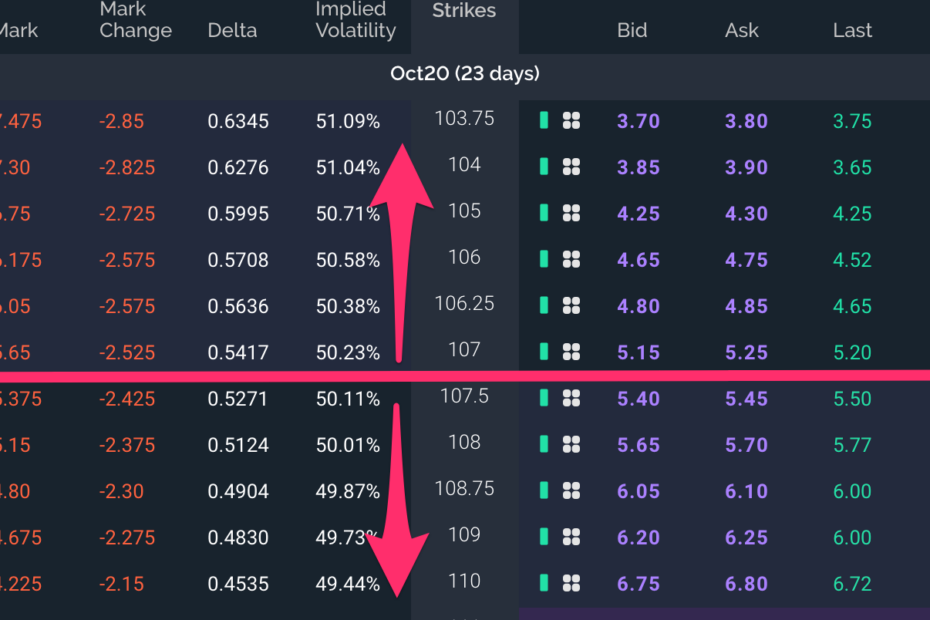

The goal for an investor is to hold a call option with a strike price higher than the current stock price. For a put option, money is made if the price declines below the strike price. Options are for a fixed time period, and the investor pays a premium that increases with time.

Out-of-the-money options are those where the option would expire worthless unless the price changes in the proper direction. Out-of-the-money calls have strike prices that are higher than the current stock price, and puts work the opposite.

An Example of Out-of-the-Money Options

If XYZ stock is currently priced at $18, a call option for $20 is considered out-of-the-money. If the price does not rise above $20, the option is worthless, and at expiration, the investor will receive nothing.

If the option expiring in one month cost the investor $2, the investor is out his $200 (for an option on 100 shares.) Even if the price goes to $21, the investor has lost at least $100. Commissions are charged when the option is bought and if it is sold.

Options are a Risky Investment

An options investor has to anticipate the direction the stock price will move. It also has to move during the defined period. In the above example, anything less than a 10% positive move in one month will result in the investor losing everything. A 20% move in the right direction will result in a break even.

It requires more than a 20% move anticipated properly in order to make any money. The speculative nature of the investment can pay off if there is huge move. In this case, a run to $40 would pay off in $2,000 per option.

Speculating in Options

The above is only an example, and option premiums and stock movements vary. Stock movements are also very difficult to predict, and moves of more than 20% in a short time are unusual. Betting on a horse race can produce similar odds against success.

Time is the enemy of the option holder. The premium decreases with time, unless there is a change in the price of the stock. The best strategy is to time the option purchase around an anticipated event, such as an earnings report or shareholders meeting.

Options reduce risk when paired with a complementary stock purchase. Naked options, particulary out-of-the-money, are similar to gambling at a casino. Never bet money you can’t afford to lose.