Online stock trading securities that trend can be a very lucrative activity. Trends represent certain directions of price movement for securities, and when a trend can be spotted, a good guess about its near future course can be made, allowing for very profitable trading. Investors at discount trading sites like Robinhood, E-Trade, and TD Ameritradee can use basic tools to analyze trending stock, and invest accordingly. Following is some advice on trading stocks that trend online.

What is a Trend in Stock Trading?

A trend is nothing more than a direction of price movement of a security. For instance, if a stock has shown steady improvement over two weeks, it is trending up (on an uptrend), and it may continue to do so. This does not mean that each day’s close was higher than that of the last, but simply that overall, the stock has steadily increased; a short term moving average would have an upward slope. Conversely, if a stock drops steadily over a period, even if it does show some volatility from day to day, it has experienced a downtrend.

How to Spot Stock Trends

Although there are certain indicators that can help investors spot stock trends, it is never possible to completely predict the future course of stock. Even if a stock has shown steady improvement, it is always possible that a trend could end at once, and the stock could decrease in value. Catching trends early is key. To do this, basic fundamental entities that can influence a company’s stock should be considered. Any news, or revelations such as an earnings report can be paired with a stock’s recent activity. For instance, if a company revealed wonderful reports, and it experienced recent positive publicity, a jump in price just after that might be more than just an insignificant price fluctuation; its stock could be beginning or continuing an uptrend.

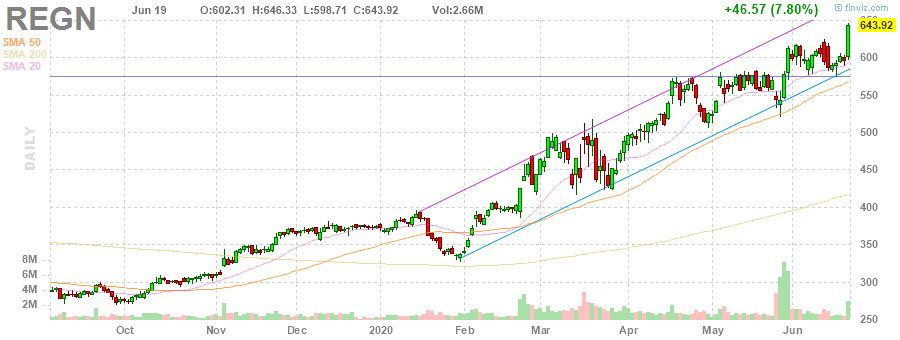

Even when such evidence of trends is not available, standard indicators, such as moving averages can help to indicate trends. These show the average price as it changes over set periods, and the slope of the average can be used to designate the direction of a stock’s price movement. Using the moving average ribbon is another great tactic in finding trends. When short term averages cross the long term averages, new overall stock trends result.

Trading Stock Trends Online

To trade stocks online according to their trending in certain directions, charts must be used. It can be very difficult to catch trends early, but recent activity of a security’s, paired with any news can give traders of all levels insight into the current price trend of stock. Looking at candlestick charts with moving averages is also very key. At online trade sites, investors may select certain securities, and analyze their histories with these charts.

Histories that show steady (even if only for a few days) price movement in a certain direction may reveal trending, and stock traders can capitalize on this. If a stock seems to be trending up, a buy stop-loss order at a higher than market value price will be triggered only if the uptrend continues to the set price, and after that, shares may be sold (via limit or trailing stop exchange) after it keeps rising or rises more and then turns around if the trend is good.

Conclusion

Trends, though hard to pinpoint, can give traders great investment opportunities. A stock caught early on an uptrend may be bought while it is relatively low, and sold at a higher price if the trend continues, netting favorable returns.

By clicking on the click and signing up for an account, I earn a commission, no extra on your part 🙂