Overbought stock is stock that has its price driven up sharply and suddenly because of investors buying into it rapidly. This can result from several causes, and there are some ways to tell if a security is overbought. Following is some information on this stock trading phenomenon.

What is Overbought Stock in Investing?

Overbought stock (the opposite of oversold stock) is any security that has an unjustifiably high trading price after a sharp increase in value simply because of high demand. It is often seen as trading above its actual worth.

For example, if there is any positive, or optimistic news about a security, which may be meant to simply indicate the possibility of its increasing in the future by even a little bit, it can cause high volumes of bullish investors to rapidly buy into it, causing its price to rise so much that it trades above what might be considered its actual worth, leading it to be overbought.

How to Tell if Stock is Overbought

The most basic way to find overbought stock is to find a security with a value that sharply and suddenly increased. Although this can be representative of its actual worth increasing, quite often, it simply results from investors buying into it and driving the value up, perhaps in response to any news, even if it is misinterpreted, that could indicate favorable course for that stock.

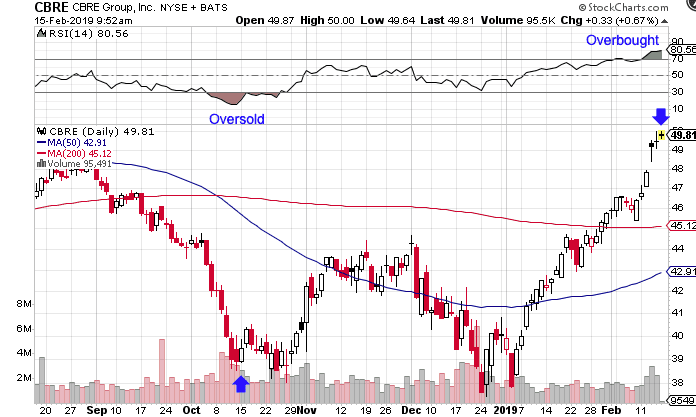

Another way to find overbought stock is to reference the relative strength index (RSI) for a given security. Generally, if this is above 70, the stock is considered overbought. Free charts at discount trade websites like E-Trade, Scottrade, TradeKing, and TD Ameritrade allow people to review any security’s history, and find indicators, including RSI.

How to React to Overbought Stock

A security’s being overbought does not necessarily indicate that its price will drop at once. Even if it is trading unjustifiably high, because its value only results from high demand and positive sentiment, if optimistic views are maintained, it could even continue rising. However, when overbought, with an RSI of over 70, a dip in a stock’s price could very well indicate that it will drop back to more modest rates. To invest with success, make a prediction about whether or not the value will continue rising, and trade accordingly.

Overbought stock is simply any security that trades very high because of high demand, which makes its value higher than its worth. This is a very relative definition, and it can be hard to pinpoint when a stock is overbought, as this stock trading phenomenon simply results from the sentiment of the investors.

By clicking on the click and signing up for an account, I earn a commission, no extra on your part 🙂