Investors and traders in stocks use either fundamental analysis or technical analysis as the basis for purchase and sales decisions. Fundamental analysis is often associated with a “buy and hold” investment strategy, while technical analysis is more often used for short term trading.

Overview of Fundamental Analysis

Fundamental analysis seeks to determine the value of a company’s stock by assessing the overall value of a company. It seeks answers to questions about the fundamental of a company, its industry group, and its sector, with the company information being the most important. Is this sector “in favor” right now? Are the prospects for this industry bright or the opposite? Is the company well managed? What is its cash position? Are its profits constantly increasing and do they maintain dividend growth?

The information reviewed in fundamental analysis tends to come from a company’s balance sheet or annual report, or from industry and company assessments by various profession analysts. For retail stocks, the information might be available by a tour of stores or malls and observing what appears to be the next hot item.

Basics of Technical Analysis

Martin J. Pring, in his monumental book, Technical Analysis Explained, 4th edition (McGraw Hill, 2002), defines technical analysis as “a reflection of the idea that prices move in trends that are determined by the changing attitudes of investors toward a variety of economic, monetary, political, and psychological forces.” Stated another way, by review of changes in price and volume of sales it is possible to determine where a stock’s price is relative to what people perceive its value to be.

Investment decisions are made by people. These people buy a stock when they feel it’s undervalued and sell it when they feel it’s overvalued. The technical analyst tries to determine where the majority of investors are in their assessment of the overall market and of a company in particular.

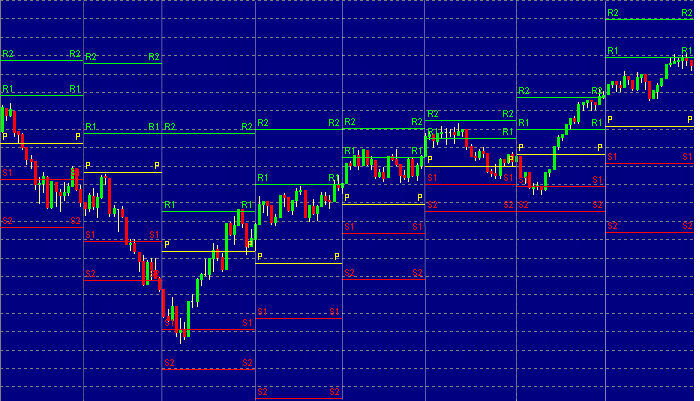

The information the technical analyst assesses is price and volume. This could be of an individual stock, an industry or sector grouping, or of an overall market. The technical analyst is not interested in the long term prospect for the company, industry, or sector. The only goal is to determine how a stock is trending, if the trend is strong, if the trend seems likely to continue, or if a trend reversal is about to take place.

This is an over-simplification, because technical analysis can be used by a buy-and-hold investor to plan entry and exit to an investment.

What Does Technical Analysis Really Measure?

While technical analysis deals with price and volume, and finds hundreds of ways to express price and volume into technical indicators, technical analysis really measures investor sentiment. Investors—those who plan on holding stocks for a long time—generally look at news about a company, the economy, political stability, and anything else they think will help them determine a company’s value, or the overall value of a stock market. There is somewhat of a herd mentality among investors. Technical analysis helps the trader to verify that a change in investor sentiment has occurred, and a stock or market index whose price was moving in one direction is about to move in another.

“Technical analysis deals in probabilities, never certainties,” Pring says. It will not allow exact determination of market highs and low, and does not provide perfect entry and exits for trading. But it can indicate investor sentiment and allow better short-term trading results.